Credit Card / Loan Liabilities and Settlement Solutions in UAE

If you are a credit card holder/loan holder and not making the credit card/loan payments on time, then eventually it could be really vexatious for you and especially if you are living in UAE, it would give you a real bad time.

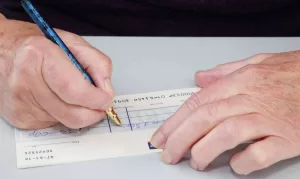

Blank cheques are asked as a security against the repayments from the credit card/loan holders by all the banks when you apply for credit cards or loans in UAE and in case of consecutive non-payments from the customer, bank deposits the security cheque with full amount and gets its bounced and further make a complaint against the customer with the police.

Credit Card Debts / Liabilities

Despite the reasons of non-payments against the credit card debts or loans, which may vary, like a medical emergency or pile of many kinds of debts or unemployment, you cannot escape from the consequences like a police case or harassment of debt collection agencies. Moreover, when you make defaults on your payments, bank uses to impose you a late payment fee plus high interest on the accumulated balance amount you owe to pay them.

Few consequences of having credit card debts/loan debts in UAE are as follows;

Calls From Debt Agency

If you are missing the credit card payments consistently and ignoring the payments reminders, then you will be contacted by the debt collectors. If you don’t answer or pick up their calls, then they may find out your office phone numbers where you work and call the HR and explain about your credit card debts, which will be so much humiliating you inside your workplace. Even after these, still you are not making the payments, then they will begin visiting your office and talk so rudely in front of your colleagues and superiors. They may search for your friends in social media and inform them about your credit card debts/ loan debts and non-payments from your side.

Depositing Your Security Cehque And Initiating The Legal Procedures

As mentioned above, banks collect blank cheques from the credit card holder/loan holder when he signs the credit card application. When the payments are missed consecutively bank uses the security cheque to deposit into your account for the full amount plus with all charges even though you have paid a certain part. Once the cheque bounces, the legal department of the bank initiates legal action by fling the police case anywhere in UAE regardless of your residence visa status. Once the case is filed, your status becomes wanted for this offence and at the same you will have a travel ban as well, so that you cannot exit from UAE and may get arrested at any point of time. Since the police and immigration systems are connected, you might get stopped at the time of leaving UAE or entering into UAE and then will be handed over to the police inside the airport.

The Ways We Can Help You To Solve

If you have too much debt, there are at least 5 credit solution strategies you can use to reduce or eliminate it: debt consolidation, debt settlement, debt restructuring, personal insolvency and putting up a defense in legal way.

Each one of these can be a viable solution for getting out of debt, depending on the circumstances you’re in and the resources you have available. Any one of these can get you out of debt when it used properly, but each has very different effects on your wallet and your credit report:

If you are really in such a drastic situation and not at all able to pay the card payments or loan payments, the best way is to defend it legally like ‘drastic situation calls for drastic measures. Our expert lawyers at Tasheel Legal Consultancy can help you out from these debt traps forever by paying some fines to the public prosecution or to the court but your credit history will be damaged for up to many years.

Tasheel Legal Consultancy can help you for Credit Card And Loan Liabilities Settlement Solutions in UAE including all the emirates Dubai, Abu Dhabi, Sharjah, Ajman, Fujairah, RAK and Umm al Quwain.

Call us: +97165363791 | +971 501750107 | +971 501758799